PANAMA CITY, PANAMA – 16 Mar, 2016 – OffshoreReviews.com launched in February 2016 has already received over 500 reviews of offshore service providers including offshore company formation services, offshore registered agents, offshore banks, offshore brokerages, offshore attorneys and offshore precious metals (gold and silver) storage facilities.

We are pleased to announce the highest rated offshore companies in each business category!

Top Rated Offshore Bank: Scotia Bank, Panama, 97% Rating

www.scotiabank.com/ca/en/0,1091,2,00.html

www.offshorereviews.com/provider/scotia-bank-reviews

Top Rated Offshore Incorporator: Harbor Financial Services, USA, 98.5% Rating

www.hfsoffshore.com

www.offshorereviews.com/provider/harbor-financial-services-offshore-reviews

Top Rated Offshore Registered Agent: Stafford Corporate Services, Anguilla, 99% Rating

www.offshorereviews.com/provider/stafford-corporate-services-ltd-reviews

Top Rated Offshore Brokerage: Investors Europe, Gibraltar, 98% Rating

www.investorseurope.com

www.offshorereviews.com/provider/investors-europe-reviews

Top Rated Offshore Attorney Firm: US Tax Services, Belize, 100% Rating

www.ustax.bz

www.offshorereviews.com/provider/us-tax-services-reviews

Top Rated Offshore Precious Metals Company: Global Gold Inc, Switzerland, 82% Rating

www.globalgold.ch

www.offshorereviews.com/provider/global-gold-reviews

The complete list of top rated offshore service providers can be found on the following pages.

Top rated offshore company incorporation services, also known as offshore incorporators: www.offshorereviews.com/reviews/offshore-incorporators-top-rated-reviews

Top rated offshore banks: www.offshorereviews.com/reviews/offshore-banks-top-rated-reviews

Top rated offshore registered agents: www.offshorereviews.com/reviews/registered-agents-top-rated-reviews

Top rated offshore brokerages: www.offshorereviews.com/reviews/offshore-brokerages-top-rated-reviews

Top rated offshore law firms and attorneys: www.offshorereviews.com/reviews/offshore-attorneys-and-offshore-law-firms-top-rated-reviews

Top rated offshore precious metals storage facilities: www.offshorereviews.com/reviews/offshore-precious-metals-top-rated-reviews

We actively encourage reviews from clients of offshore service firms. This is a great opportunity to share your experiences with the world. Be it a positive or negative review, it belongs on OffshoreReviews.com

Negative reviews can save potential clients from a bad experience. Good reviews pave the way for potential clients to choose with confidence.

For complete information, please visit: OffshoreReviews.com

Contact:

Azuero Business Center, Suite 672

Avenida Perez Chitre

Panama City, Panama 00395

Panama Phone: +507-836-5060

U.S. Phone: 1-305-602-3002

Info@OffshoreReviews.com

Full News Story: http://pressreleasejet.com/news/offshorereviews-com-announces-the-highest-rated-offshore-providers.html

Distributed by Press Release Jet

Media Contact

Company Name: Offshore

Contact Person: Reviews

Email: Info@OffshoreReviews.com

Phone: 305-602-3002

Country: Panama

Website: www.OffshoreReviews.com

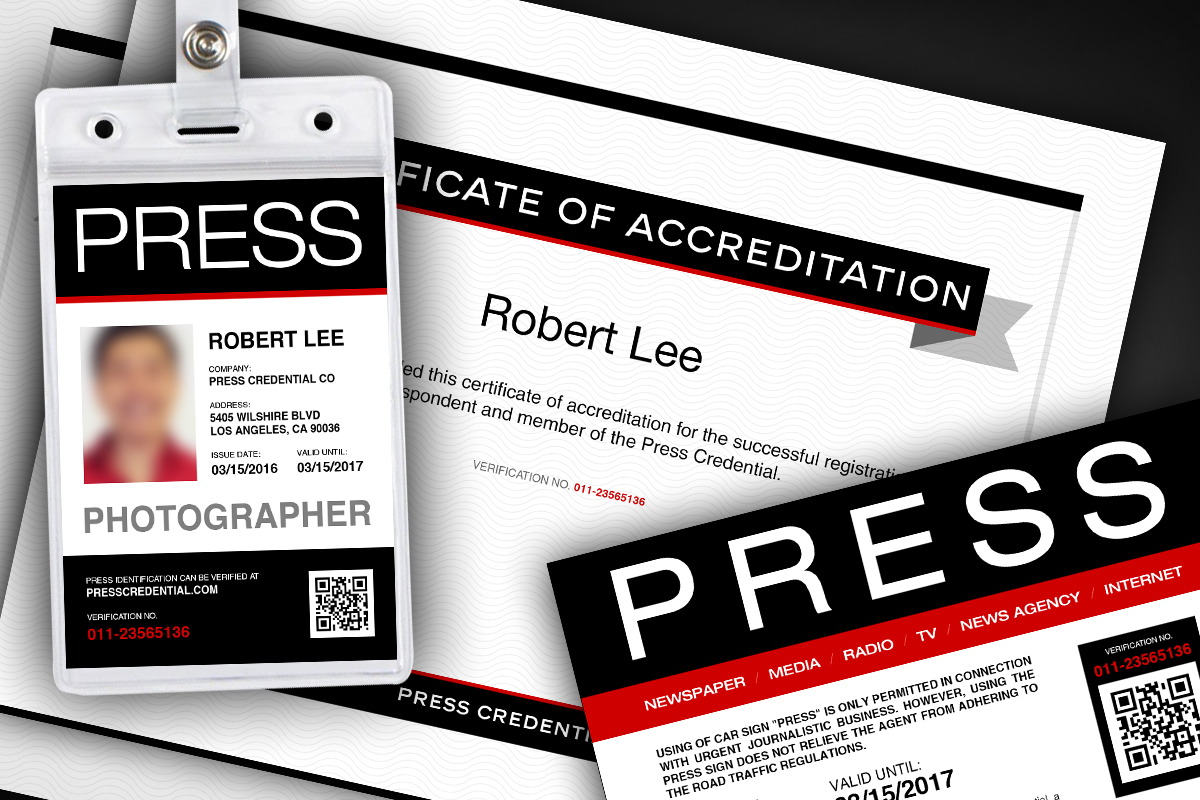

LOS ANGELES, CA – 29 Mar, 2016 – Press Credential is a journalistic authority that provides photographers, journalists and media professionals the resources to succeed in the field of media and journalism with press credential tools including press passes and press vehicle IDs.

LOS ANGELES, CA – 29 Mar, 2016 – Press Credential is a journalistic authority that provides photographers, journalists and media professionals the resources to succeed in the field of media and journalism with press credential tools including press passes and press vehicle IDs.